Euronext Dublin

Euronext Dublin

Irish indices

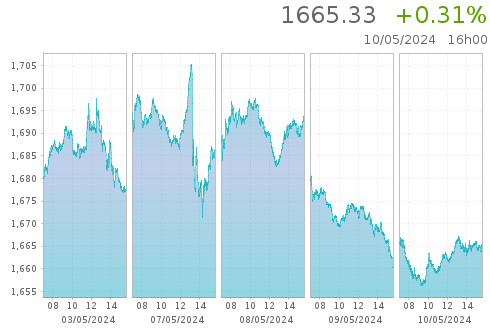

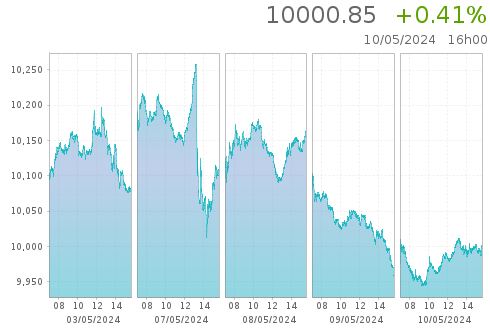

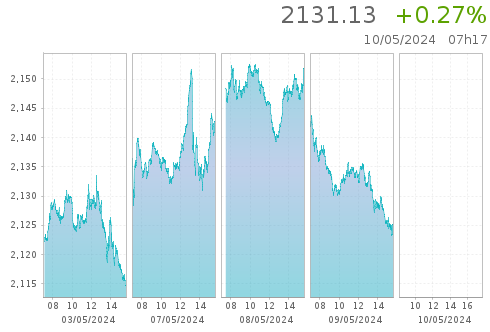

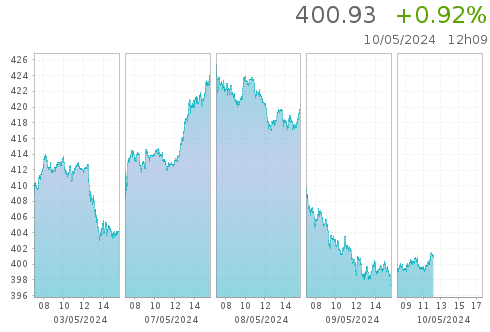

| Index | Last | % |

|---|---|---|

| ISEQ 20 | 1,646.45 | +1.15 % |

| ISEQ All Share | 9,941.69 | +1.15 % |

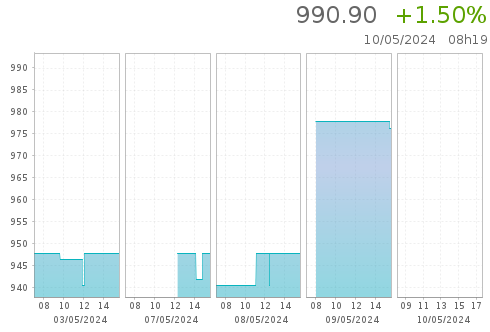

| ISEQ Small | 984.93 | -0.02 % |

| ISEQ 20 Capped | 2,097.12 | +1.10 % |

| ISEQ Financial | 408.30 | +2.32 % |

EU indices

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EURONEXT 100 | 1,500.80 | +0.41 % |

| CLIMATE EUROPE | 1,880.80 | +0.34 % |

| LOW CARBON 100 | 159.82 | +0.15 % |

| NEXT BIOTECH | 2,049.07 | +0.32 % |

| ESG 80 | 2,042.35 | +0.52 % |

Currency rates

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EUR / USD | 1.06391 | -0.05 % |

| EUR / GBP | 0.85599 | +0.03 % |

| EUR / JPY | 164.486 | -0.05 % |

| EUR / CHF | 0.97006 | -0.12 % |

| GBP / USD | 1.2429 | -0.07 % |

Cash Products

More Euronext Dublin

Learn more about our Dublin markets

Visit our Dublin page on Euronext.com and learn about our Dublin offering.