Euronext Dublin

Euronext Dublin

Irish indices

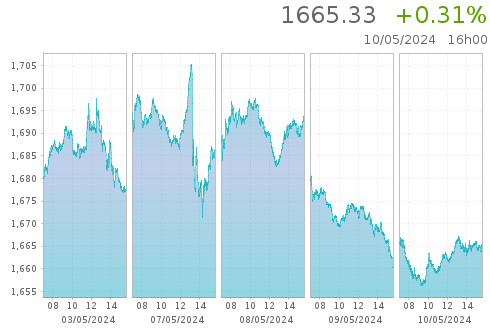

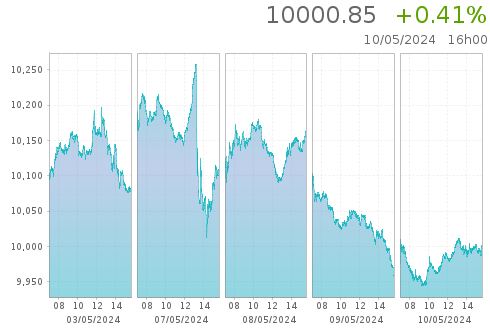

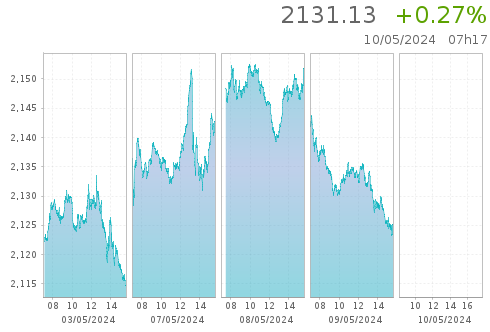

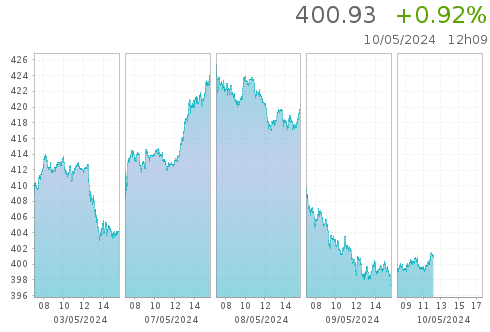

| Index | Last | % |

|---|---|---|

| ISEQ 20 | 1,645.07 | -0.41 % |

| ISEQ All Share | 9,915.57 | -0.49 % |

| ISEQ Small | 908.81 | -2.60 % |

| ISEQ 20 Capped | 2,089.87 | -0.44 % |

| ISEQ Financial | 412.08 | +0.33 % |

EU indices

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EURONEXT 100 | 1,504.93 | -0.72 % |

| CLIMATE EUROPE | 1,900.84 | -0.31 % |

| LOW CARBON 100 | 161.34 | -0.17 % |

| NEXT BIOTECH | 2,062.85 | -1.34 % |

| ESG 80 | 2,047.40 | -0.88 % |

Currency rates

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EUR / USD | 1.07268 | -0.03 % |

| EUR / GBP | 0.85790 | +0.03 % |

| EUR / JPY | 166.936 | 0.00 % |

| EUR / CHF | 0.97931 | +0.06 % |

| GBP / USD | 1.25037 | -0.06 % |

Cash Products

More Euronext Dublin

Learn more about our Dublin markets

Visit our Dublin page on Euronext.com and learn about our Dublin offering.